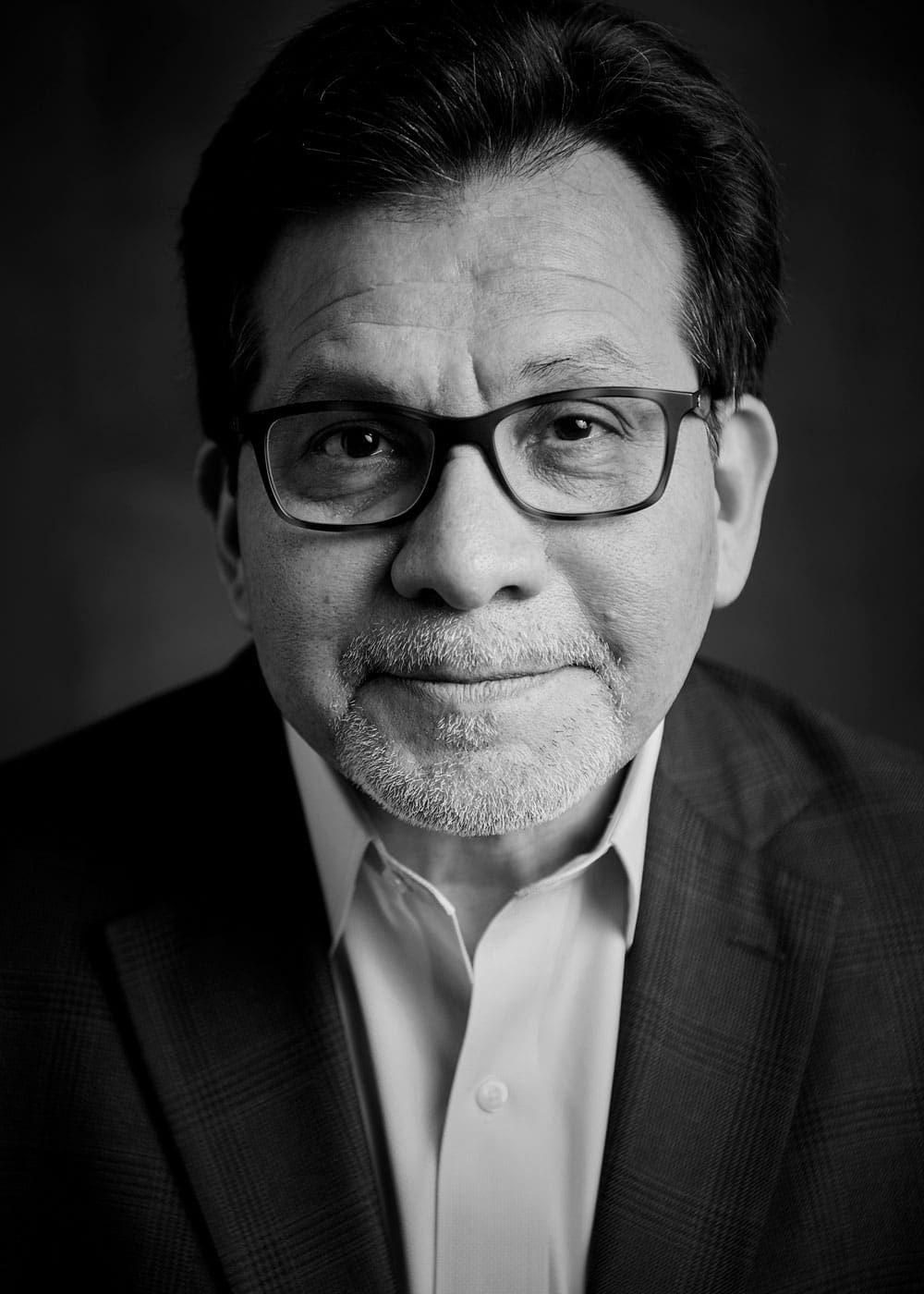

Alan grew up in Stony Brook, N.Y., as the youngest of five children in a middle class family.

“We didn’t have a lot of money,” he says. “There was no talk of how to manage finances. We kind of all had to figure that out on our own.”

Alan remembers hearing a lot of music growing up.

“My mom used to play the piano and sing songs from the Great American Songbook, and I would look over her shoulder and try to see who wrote the songs. It was very interesting to me. It was like a game of concentration.”

When Alan was a teenager, his family moved to California. His older brother had the idea to spend their garage sale money on electric guitars.

“I bought a purple Flying V and a small little amplifier.”

That was all that it took. Having discovered his passion for playing, singing and composing, Alan immersed himself in music with the kind of thoughtfulness and determination that can only lead to success. Success that, for him, would come at a very high cost.

His relationship with debt began the day that he moved out of his parents’ house. Alan was lured into signing up for a credit card in the student union building during college orientation. Initially, he used the $500 limit to cover the cost of books and supplies.

“Little did I know that little loan would turn into a mountain of credit card debt,” he says.

After traveling, touring and wandering, Alan relocated to New York. He earned coveted slots at New York clubs and worked alongside music industry legends, including extended stints with Sony Music Entertainment—working under Grammy Award-winning record producer and executive Peter Asher and at New Line Cinema during the making of The Lord of the Rings.

As Alan’s career and public life grew more fulfilling, his financial life moved in the opposite direction. For years, he struggled just to make the minimum monthly payments. With no realistic end in sight, he figured his best bet was on himself and his ability to write a hit song that could save him from the mounting debt. Again, he continued to take advantage of new, higher credit limits and loan offers. As the number rose, he sank further into financial despair and desperation.

He decided to try his luck in the Nashville songwriting community.

“I just wanted a new start. Nashville seemed like a great community. It seemed like a great place where I could have a nice lifestyle and also seemed like I could drop in and make a bunch of cash and leave. To be honest, that’s what I thought,” Alan says. “But it didn’t go that way.”

Teaching private music lessons and doing graphic design and web development work sustained him at first. Eventually, he found work backing up other artists, in the studio and on the road, and he worked his way into publishing and producing. By then, having rolled his student loan in with the credit card debt, he was faced with what seemed like an insurmountable number.

“My financial life was a mess. That spilled over into my personal life, of course. I definitely spent a few nights sleeping in my car. I couldn’t go to a lot of the events that a lot of my colleagues were going to. I had to spend many nights just … keeping myself busy.”

He tried to focus on writing music and staying positive as best he could, but admits that he felt like he was drifting.

“I thought, ‘Oh I’ll just get a hit song; something great will happen. I’ll get a reset.’ It just doesn’t work that way. Or it didn’t work that way for me,” he says. “At some point, I realized I’m not going to be able to climb this mountain by myself.”

He did some research, cobbled together a financial rehabilitation plan and decided it was time to get into communication. That’s when, he says, everything started to turn around for him. Someone tipped him off about the Financial Empowerment Center, a partnership between United Way and the Mayor’s Office.

“I couldn’t believe that there were people who did that kind of work at no cost to me. Just having an ear, someone to talk to about my situation, someone to communicate with to lay out a plan—that made all the difference for me.”

“When I first went to the Financial Empowerment Center, I would say my first session was pretty emotional.”

He sat down with a financial counselor and began to draw out a plan. He and his counselor met regularly to work through his debt and improve his credit.

Before going to the FEC, Alan would overdraft his bank account and would rack up fees regularly. He says he was just behind the curve—in many ways.

Now, with the help of the FEC, he is no longer in debt. And, his credit scores have rebounded to the mid-750s. He has learned to be deliberate and methodical about what he calls his financial fitness program.

“I like to call it that because it’s nonstop; it’s something that I do every day. In fact, I would say that when I came across the Financial Empowerment Center is when my fitness program really began.”

The FEC taught him the importance of regularly checking his bank accounts and how to begin living within his means. Now, he knows that he has developed the skills that it takes to continue on his trajectory. He knows that he would not have reached that place without the community he found at the FEC.

“Communication [with your financial counselor] is everything. Until I started communicating with my counselor, there was no hope for me financially. Without communication, it’s easy to feel disconnected and hopeless. Fortunately, I did get into communication and now I’m full of hope, truly.”