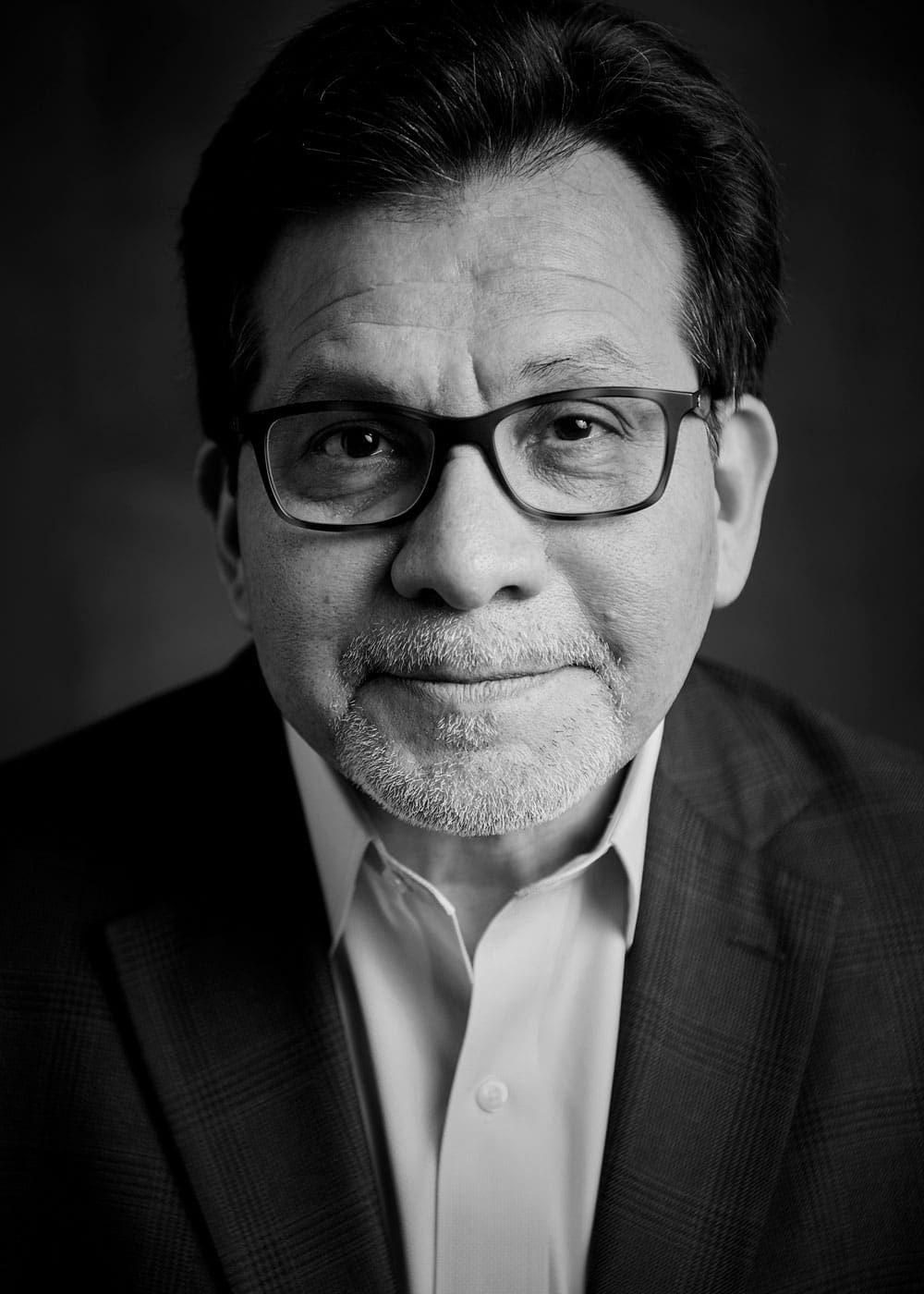

Nearly 25 years later, Freda has been hired on full-time, risen the ranks at The Housing Fund and is guiding and teaching other homeowners who were once in her shoes.

In the late 90s, Freda was a single mom to two kids. She was 25 years old, and all her income went to keeping her family afloat, which left little room for savings.

“We always lived in apartments, and we moved every year,” she says. “Every year, the rent went up and it was just hard to afford with two small kids.”

A friend encouraged her to look into home ownership.

“I thought, ‘Oh, I can’t afford a home,’ ” she remembers. “I was always told being Black, you probably won’t be able to buy a home. That’s what my parents were always told.”

She got connected with The Housing Fund and found a new build in North Nashville that she fell in love with. Through their down payment assistance program, she was able to close on her first home in September 1996.

At the time, she was working for Metropolitan Development and Housing Agency. But when The Housing Fund was looking for a loan underwriter, she decided to apply.

“I’ve always been an administrative assistant or executive secretary but never had the experience of underwriting loans,” she says. “I interviewed and there was a lot of qualified people, but I really think my safe haven was that I was the second person that used the down payment assistance to the organization. So, they trained me, and they needed a face to be out there, to talk to the people and help people understand that you can purchase a home being an 80 percent of medium income and single with two small kids.”

She moved over to the collections side of the agency—because they needed someone firm with those who were behind on their payments.

“You know, I’ve been in their place. So, I was better able to understand what they was going through. And I helped a whole lot of them out as far as trying to understand how to pay your bills on time. I would always tell them, ‘If you do run into some kind of hardship, reach out and communicate. Because if you don’t communicate, I won’t know.’ ”

After 16 years, she’s back in underwriting loans and has added home-buying education to her repertoire.

“I talk to prospective customers that have applied for a loan and help them understand their application and some advantages and disadvantages of home ownership they would be experiencing throughout the process and throughout their tenure of owning their home.”

In September, United Way selected The Housing Fund as a grant recipient for Metro Nashville CARES funding. The Housing Fund was able to use that grant to help their clients with mortgage payments and utility bills.

She says some of the biggest challenges her clients face right now are a loss of wages due to COVID.

“Most of their mortgages went into forbearance. Some of them didn’t understand what forbearance was, so they just jumped on it because they realized they didn’t have to make a payment and not knowing once that forbearance is up, they had to come with that sum of money. So luckily, The Housing Fund was able to help some of those to understand what forbearance was and try to direct them to the right place to get help.”

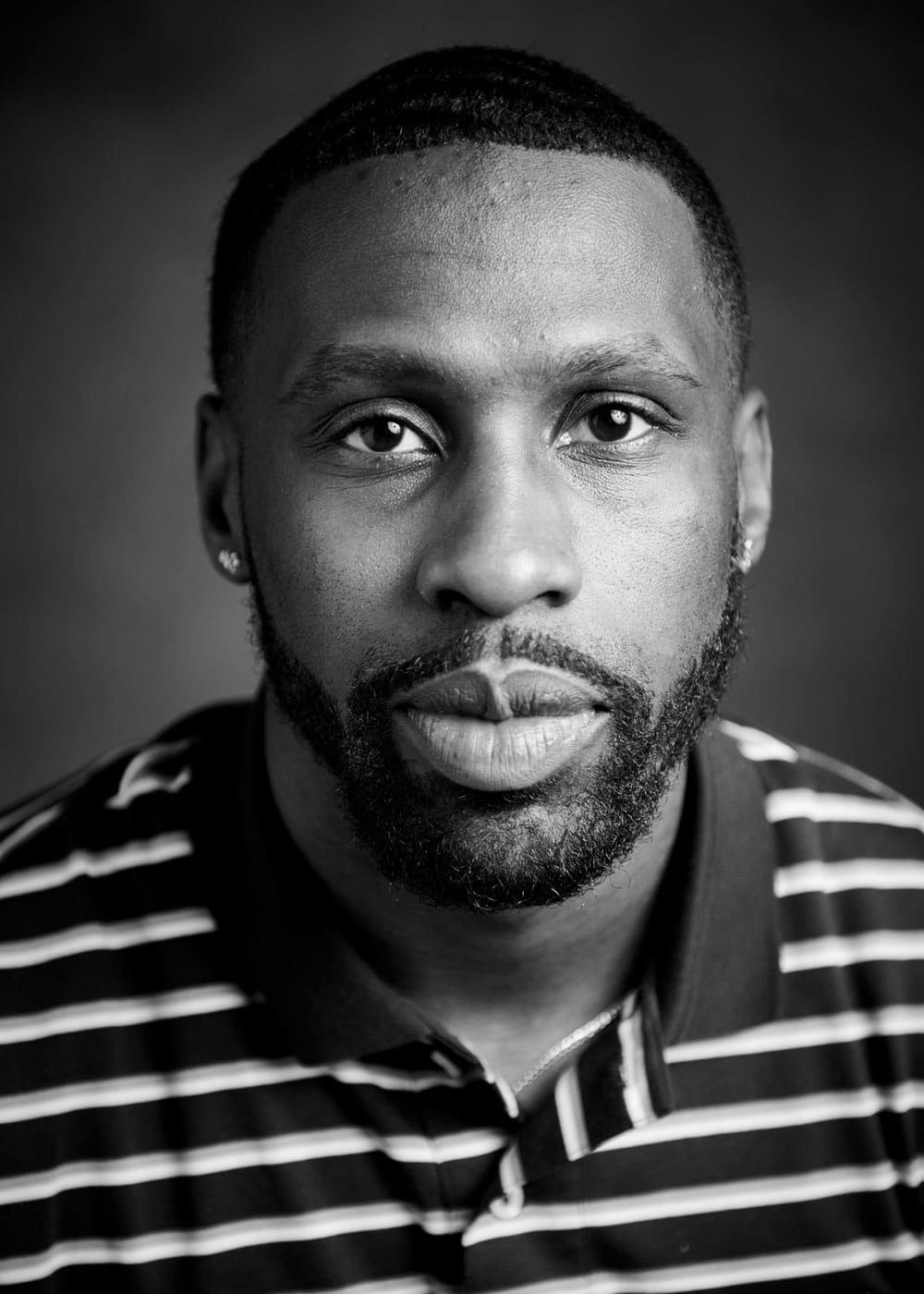

She remembers one man in particular—a struggling single father who had a heart attack and lost his job in construction.

“He called me; he cried. I gave him some comforting words and told him that those boys—he had two small boys—they needed him and just keep the faith and things would change. I told him some avenues where he can go get some help for food. If he needed help on his rent, I gave him a couple of names and, avenues that he can go to get help,” she says. “He called me back in January of this year to say things are looking great. He found a job and said the boys are great. So, he was very grateful and he keeps in touch.”

She sees herself in young parents who are doing everything they can to make ends meet. She’s reminded that not too long ago, she faced those same challenges. Freda says if she’s learned anything throughout the pandemic, it’s to be humble.

“You never know what people are going through. Just be humble and reassure them that things are going to be all right. I’m not here to judge. I’m here to help, to let them know that there are organizations out there to help. It might look bad now but give it a little time. It’ll get much better.”